Mordor Intelligence, a global leader in market research and advisory services, reports that the service robotics market size is valued at USD 86.02 billion in 2026 and is projected to reach USD 209.72 billion by 2031, registering a strong 19.51% CAGR during the forecast period.

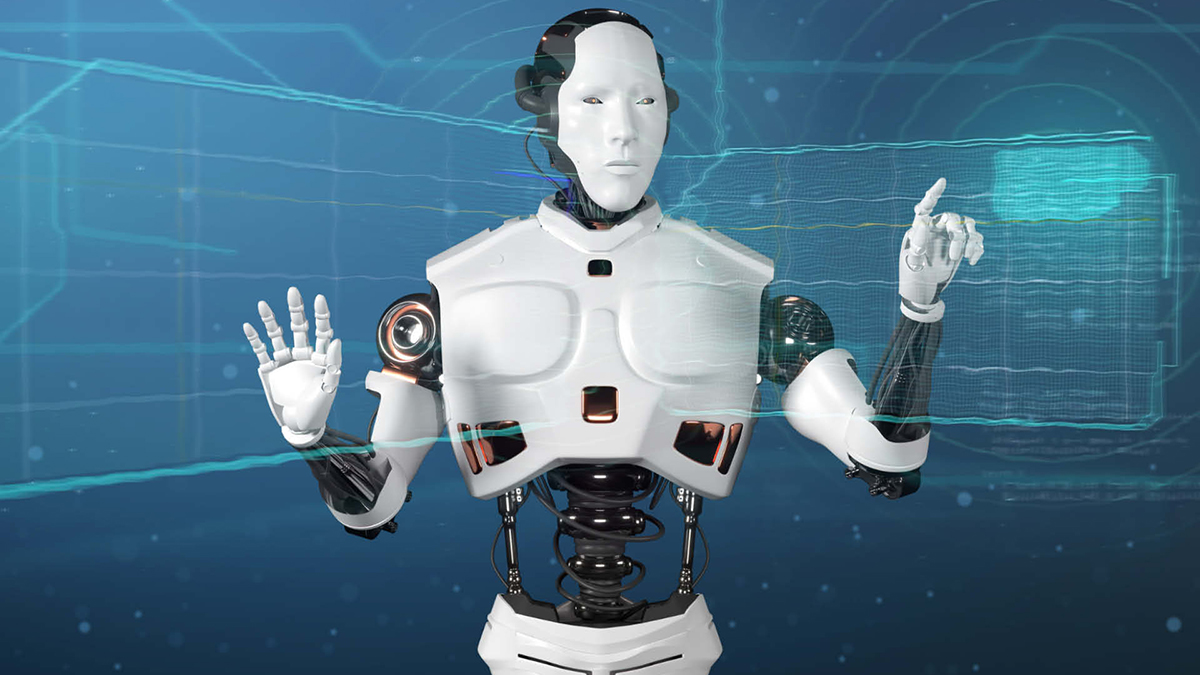

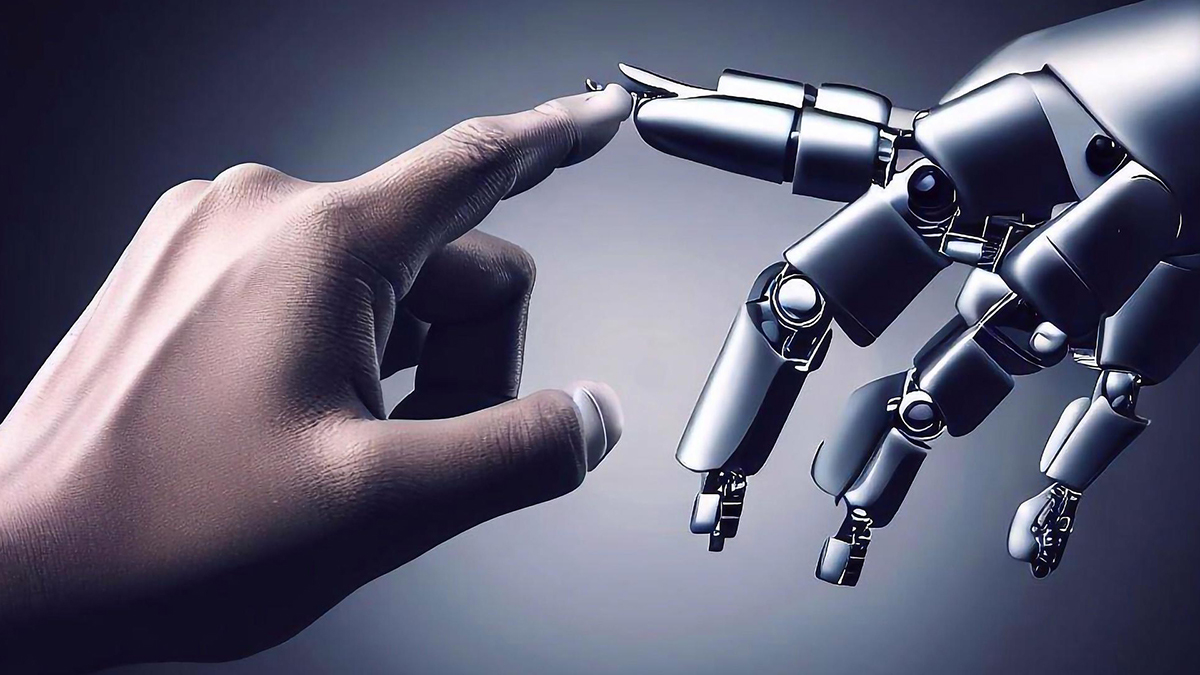

The accelerating deployment of robots in non-industrial environments is reshaping how services are delivered across healthcare, logistics, retail, hospitality, and personal assistance. The service robotics market is benefiting from advances in artificial intelligence, computer vision, and autonomous navigation, enabling robots to operate safely alongside humans in complex real-world settings.

According to Mordor Intelligence, sustained investments in automation, rising labor costs, and increasing demand for contactless services are supporting long-term service robotics market growth. As robots transition from experimental deployments to scalable commercial solutions, the service robotics market forecast points toward diversified adoption across both professional and domestic applications worldwide.

Service Robotics Market Trends Shaping the Next Five Years

Subscription Models Expanding Access to Service Robotics

Flexible subscription-based deployment models are making service robots far more accessible to smaller organizations. Instead of heavy upfront investments, businesses can now adopt robots through operating expenses that align better with cash flows. Bundled support, software updates, and maintenance further reduce operational risk and simplify ownership. This shift is helping service robotics move beyond large enterprises and into everyday commercial use.

Labor Gaps and Demographic Shifts Driving Adoption

Workforce constraints and shifting demographics are increasingly pushing organizations to rethink how services are delivered. As labor availability tightens across logistics, healthcare, and hospitality, service robots are stepping in to handle repetitive and physically demanding tasks. Public support programs and insurance-backed incentives are also making assistive technologies more accessible to institutions and households. Together, these factors are turning service robotics into a practical response to long-term staffing and care challenges rather than a short-term automation trend.

Service Robotics Market Segmentation Overview

By Field of Application

- Professional Field Robots

- Professional cleaning robots

- Inspection and maintenance robots

- Construction and demolition robots

- Logistics systems robots

- Medical robots

- Rescue and security robots

- Defense robots

- Underwater systems

- Powered human exoskeletons

- Public-relation robots

- Personal / Domestic Robots

- Domestic task robots

- Entertainment robots

- Elderly and handicap assistance robots

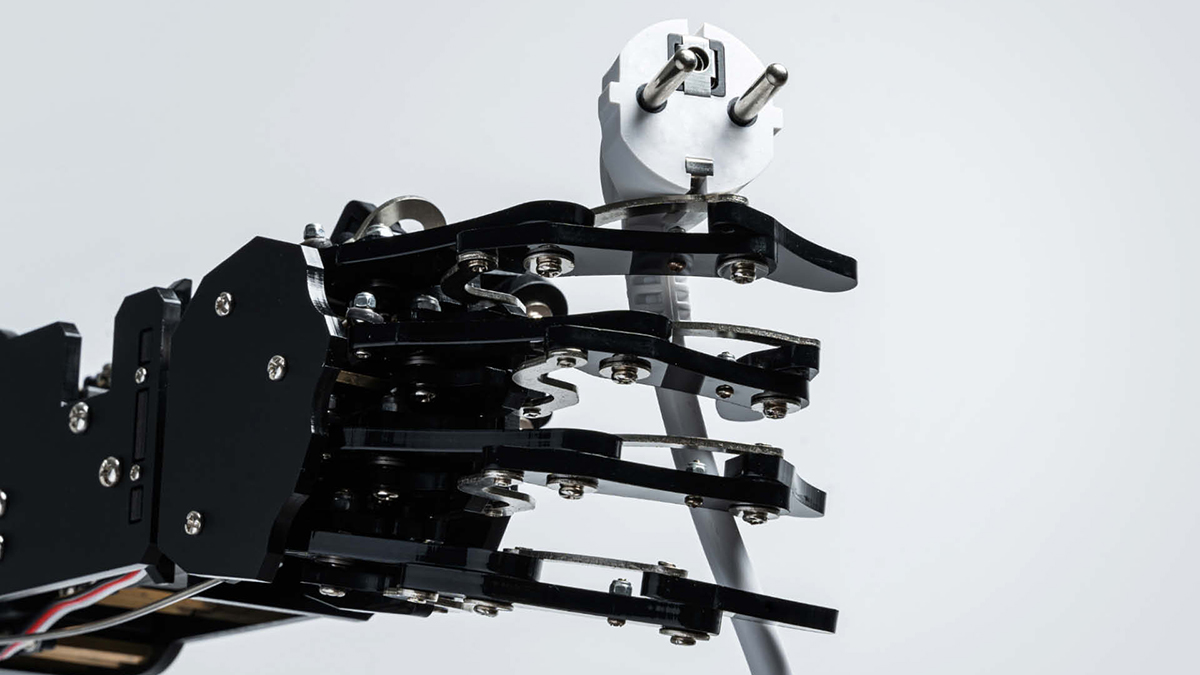

By Component

- Hardware

- Sensors

- Actuators

- Controllers and drives

- Power systems

- Software

- Operating systems and middleware

- AI and analytics algorithms

- Services

By Operating Environment

- Ground

- Aerial / UAV

- Marine / Underwater

By Mobility

- Mobile / autonomous

- Stationary / fixed-base

By End-User Industry

- Healthcare and medical

- Logistics and warehousing

- Agriculture

- Construction and demolition

- Defense and security

- Hospitality and retail

- Education and entertainment

By Geography

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

- Middle East

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

- South America

- Brazil

- Argentina

- Rest of South America

Service Robotics Market Regional Outlook

Asia-Pacific stands out as the most dynamic region for service robotics adoption, driven by strong manufacturing ecosystems and active government support. Countries across the region are accelerating the use of robots in healthcare, logistics, agriculture, and elder care, helping address labor shortages and rising service demands. Domestic innovation is playing a major role, with local companies scaling production and tailoring robots for real-world, high-volume use. Growing experimentation beyond major cities is further widening adoption across commercial and public sectors.

North America continues to be a major contributor to the service of robotics landscape, supported by early technology adoption and strong institutional demand. Healthcare facilities and warehouses remain key areas of deployment, while defense and inspection applications add depth to the market. Regulatory flexibility is also encouraging wider use of aerial and autonomous systems. Together, these factors are helping sustain steady uptake across both commercial and government-backed projects.

Leading Companies in the Service Robotics Industry

The service robotics industry remains moderately fragmented, with global players competing in innovation, software capabilities, and application-specific solutions. Key companies covered by Mordor Intelligence include:

- iRobot Corporation

- Dematic Corp.

- Daifuku Co. Ltd.

- Swisslog Holding AG (KUKA)

Ongoing R&D investments, strategic partnerships, and application-focused product launches continue to shape competitive positioning and service robotics market share dynamics.