Waton Securities International Limited (Waton Securities), a leading licensed broker in Hong Kong and a pioneering SaaS service provider, officially launched its latest product, the AI Investor Relations Officer (AI-IRO), at the 10th Investor Relations Awards organized by the Hong Kong Investor Relations Association (HKIRA).

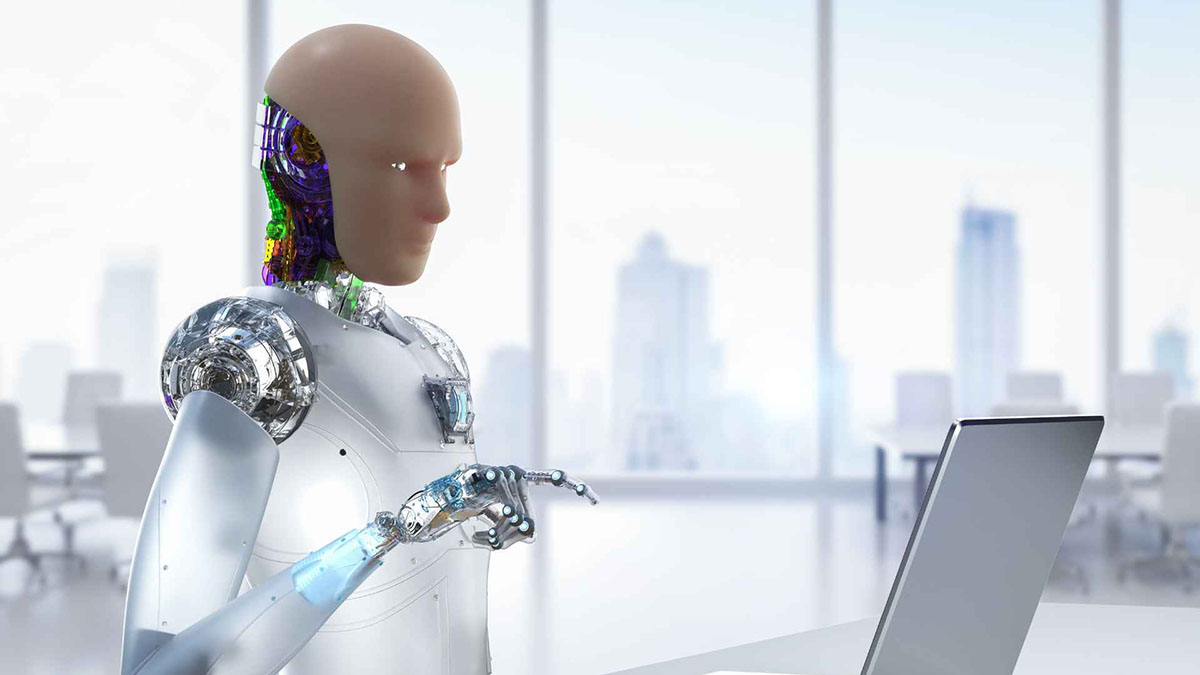

Designed to meet the distinct needs of public companies, the AI-IRO aims to accelerate the practice of investor relations into the advanced era of artificial intelligence. By leveraging comprehensive big data from the capital markets, AI-IRO significantly boosts the productivity of investor relations tasks and enhances corporate brand image.

Technically, Waton Securities has partnered strategically with Amazon Web Services, utilizing their cutting-edge Claude series of large language models and strong tech support. This, combined with advanced vector knowledge bases, text-to-speech, and speech-to-text technologies, ensures robust AI performance. The firm also employs state-of-the-art encryption and strict data management processes to protect information security and ensure compliance with disclosure standards.

Traditionally, investor relations teams struggle to meet the constant communication demands of investors. AI-IRO addresses this by integrating the company’s compliance database and market information, thus becoming an intelligent assistant that aligns with the company’s culture. It generates accurate, consistent responses and provides round-the-clock feedback, thereby continually building the trust with investors.

Besides, AI-IRO enables investor relations professionals to enhance their work efficiency significantly, particularly in tasks such as market data collection, preparation of IR materials, generation of press release, and organizing meeting minutes, sharply reducing the time and labor required.

Generative AI is transforming the financial industry, unlocking new levels of productivity. AI-IRO’s algorithms and models are now critical competitive assets for financial institutions, optimizing decision-making processes, reducing operational costs, and providing personalized financial services.

According to the “2024 Financial Industry Generative Artificial Intelligence Application Report” by Tsinghua University’s School of Economics and Management and other authoritative research centers, generative AI is projected to contribute an additional $30 trillion to the financial sector, potentially revolutionizing transactions, investment management, and risk assessment within three years.

Waton Securities emphasized its commitment to leveraging its extensive expertise in financial technology, leading with an international team of doctorate-level professionals, and harnessing exclusive, cutting-edge AI technologies. The company aims to deliver transformative AI-driven solutions that democratize the benefits of financial technology and foster a future where technology is both advanced and compassionate.