After years of investing, hiring talent, and launching pilots in artificial intelligence (AI), CEOs are now seeking tangible returns from the technology. But realizing its full value remains difficult. Even with the widespread implementation of AI programs across industries, only 26% of companies have developed the necessary set of capabilities to move beyond proofs of concept and generate tangible value, according to new research by Boston Consulting Group (BCG).

The report, titled Where’s the Value in AI?, is based on a comprehensive survey of 1,000 CxOs and senior executives from over 20 sectors, spanning 59 countries in Asia, Europe, and North America, and covering ten major industries. Participants were asked to assess their companies’ AI maturity in 30 key enterprise capabilities.

While just 4% of companies have developed cutting-edge AI capabilities across functions and consistently generate significant value, an additional 22% have implemented an AI strategy, built advanced capabilities, and are beginning to realize substantial gains. The report designates these companies as leaders. Seventy-four percent of companies have yet to show tangible value from their use of AI.

“AI leaders are raising the bar with more ambitious goals,” said Nicolas de Bellefonds, a BCG senior partner, managing director, and coauthor of the report. “They target meaningful outcomes on cost and topline and prioritize core function transformation over diffuse productivity gains.”

Leaders Far Outperform the Rest

Over the past three years, AI leaders have achieved 1.5 times higher revenue growth, 1.6 times greater shareholder returns, and 1.4 times higher returns on invested capital. They also excel in non-financial areas like patents filed and employee satisfaction.

According to the report, leaders have six differentiating characteristics:

- They focus on the core business processes as well as support functions. In fact, AI’s greatest value lies in core business processes where leaders are generating 62% of the value. Leveraging AI in both core business and support functions gives these companies a competitive advantage.

- They are more ambitious. Leaders look beyond pure productivity plays and back their ambitions with investment in AI and workforce enablement, making twice the investment in digital, double the people allocation, and twice as many AI solutions scaled. Leaders expect 60% higher AI-driven revenue growth and nearly 50% greater cost reductions by 2027 compared with others.

- They integrate AI in both cost and revenue generation efforts. Almost 45% of leaders integrate AI in their cost transformation efforts across functions (compared with only 10% of others). More than a third of leaders focus on revenue-generation from AI, compared with only a quarter of other companies.

- They invest strategically in a few high-priority opportunities to scale and maximize AI’s value. Data on AI adoption shows that leaders pursue, on average, only about half as many opportunities as their less advanced peers. Leaders focus on the most promising initiatives, and they expect more than twice the ROI in 2024 that other companies do. In addition, leaders successfully scale more than twice as many AI products and services across their organizations.

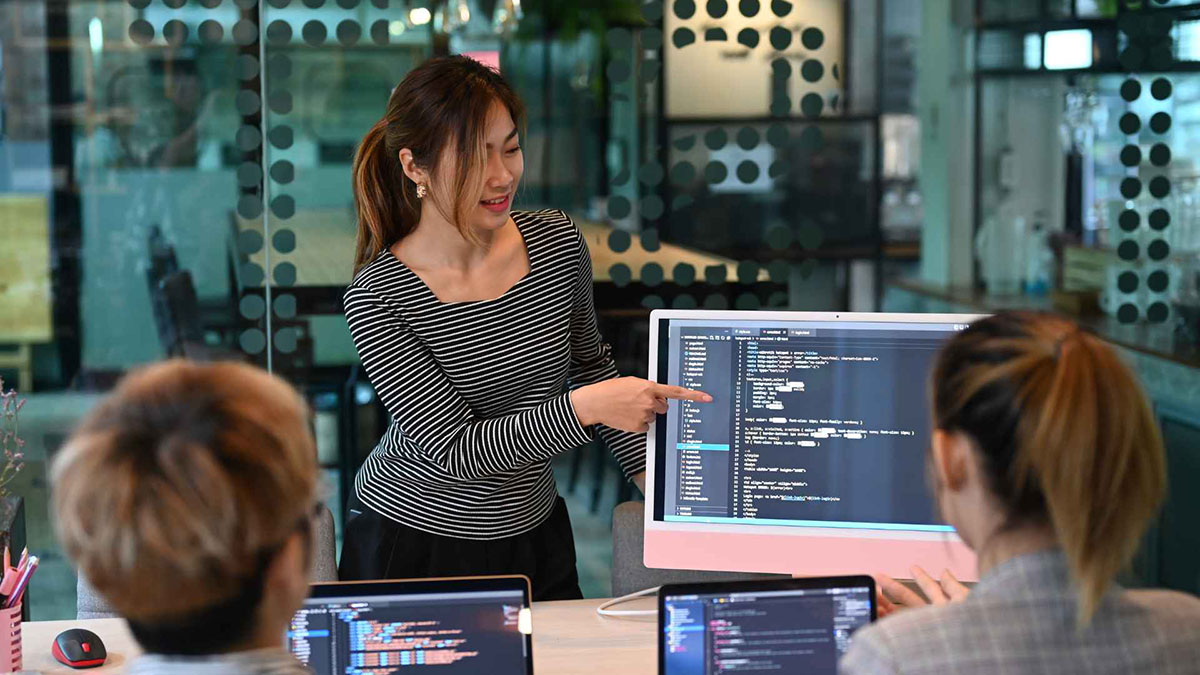

- They focus their efforts on people and processes over technology and algorithms. Leaders follow the rule of putting 10% of their resources into algorithms, 20% into technology and data, and 70% in people and processes.

- They have moved quickly to focus on GenAI. Leaders use both predictive AI and GenAI, and they are faster in adopting GenAI, which opens opportunities in content creation, qualitative reasoning, and orchestration of other systems.

Sectors with the highest concentration of AI leaders are typically those that experienced digital disruption early, around a decade and a half ago, giving them a head start in developing robust digital capabilities. These include fintech (49% are leaders), software (46%), and banking (35%).

More than Half of AI Value Is Derived from Core Business Functions

“Contrary to popular belief, the true potential of AI goes well beyond support functions,” said Michael Grebe, BCG senior partner, managing director, and coauthor of the report. “In fact, 62% of AI’s value lies in core business functions, enabling leaders to harness both for a significant competitive advantage.”

The companies surveyed derive more than half of AI and generative AI value from core business functions such as operations (23%), sales and marketing (20%), and R&D (13%). Support functions contribute 38% of the value, with customer service (12%), IT (7%), and procurement (7%) being the top contributors.

Companies stand to gain by pinpointing where AI can drive the most value, with the research revealing significant variations across industries:

- Sales and marketing are rapidly becoming a key source of AI value in sectors including software (31% of AI value generated), travel and tourism (31%), media (26%), and telecommunications (25%).

- AI is making a significant impact in R&D in research-intensive sectors such as biopharma (27% of value created), medtech (19%), and automotive (29%).

- Customer service is a considerable source of AI-generated value so far in insurance (24%) and banking (18%).

- Consumer products and retail companies are making big gains with AI-driven personalization (19% and 22%).

Leaning Into the 70-20-10 Principle

The survey reveals that companies face numerous challenges when implementing AI initiatives, with around 70% stemming from people- and process-related issues, 20% attributed to technology problems, and only 10% involving AI algorithms—despite the latter often consuming a disproportionate amount of organizational time and resources. Too many lagging companies make the mistake of prioritizing the technical issues over the human ones.

An analysis of AI leaders’ capabilities, compared with other companies, shows that the key factors for scaling AI are largely people- and process-related, including change management, product development, workflow optimization, AI talent, and governance. Critical technology capabilities include data quality and management, while AI model quality and performance stand out as the top algorithm priority.

“Three-quarters of companies have yet to unlock value from AI,” said Amanda Luther, a BCG partner, managing director, and coauthor of the report. “Without decisive action, they risk falling significantly behind. This research reaffirms our long-held belief that when companies undertake digital or AI transformations, they need to focus two-thirds of their effort and resources on people-related capabilities, and the other third or so split between technology and algorithms.”