A leading healthcare technology provider focused on empowering autonomous medication management, today announced results for its fiscal year and fourth quarter ended December 31, 2025.

“We finished 2025 with solid fourth quarter financial results, delivering full year 2025 total revenues, product bookings and annual recurring revenues (‘ARR’) all above the mid-point of our previously issued guidance ranges,” stated Randall Lipps, chairman, president, chief executive officer, and founder of Omnicell. “As we look ahead, we are focused on delivering long-term, sustainable, and profitable growth. The launch of Titan XT intends to address a significant need for an enhanced and more efficient medication management experience that combines proven automation with powerful intelligence and extends beyond the pharmacy into nursing care areas. We believe that our innovation roadmap continues to resonate with our customers, and I am optimistic for what the future holds for Omnicell in 2026 and beyond.”

Financial Results

Total revenues for the fourth quarter of 2025 were $314 million, up $7 million, or 2%, from the fourth quarter of 2024. The quarter-over-quarter increase in total revenues was driven by strength in our technical service offerings and SaaS and Expert Services revenues, as well as increases in our consumables revenues. Total revenues for the year ended December 31, 2025 were $1.185 billion, up $73 million, or 7%, from the year ended December 31, 2024. The year-over-year increase in total revenues was driven by strength in our connected devices and technical service offerings, as well as increases in our SaaS and Expert Services and consumables revenues.

Total GAAP net loss for the fourth quarter of 2025 was $2 million, or $0.05 per diluted share. This compares to GAAP net income of $16 million, or $0.34 per diluted share, for the fourth quarter of 2024. Total GAAP net income for the year ended December 31, 2025 was $2 million, or $0.04 per diluted share. This compares to GAAP net income of $13 million, or $0.27 per diluted share, for the year ended December 31, 2024.

Total non-GAAP net income for the fourth quarter of 2025 was $18 million, or $0.40 per diluted share. This compares to non-GAAP net income of $28 million, or $0.60 per diluted share, for the fourth quarter of 2024. Total non-GAAP net income for the year ended December 31, 2025 was $75 million, or $1.62 per diluted share. This compares to non-GAAP net income of $79 million, or $1.71 per diluted share, for the year ended December 31, 2024.

Total non-GAAP EBITDA for the fourth quarter of 2025 was $37 million. This compares to non-GAAP EBITDA of $46 million for the fourth quarter of 2024. Total non-GAAP EBITDA for the year ended December 31, 2025 was $140 million. This compares to non-GAAP EBITDA of $136 million for the year ended December 31, 2024.

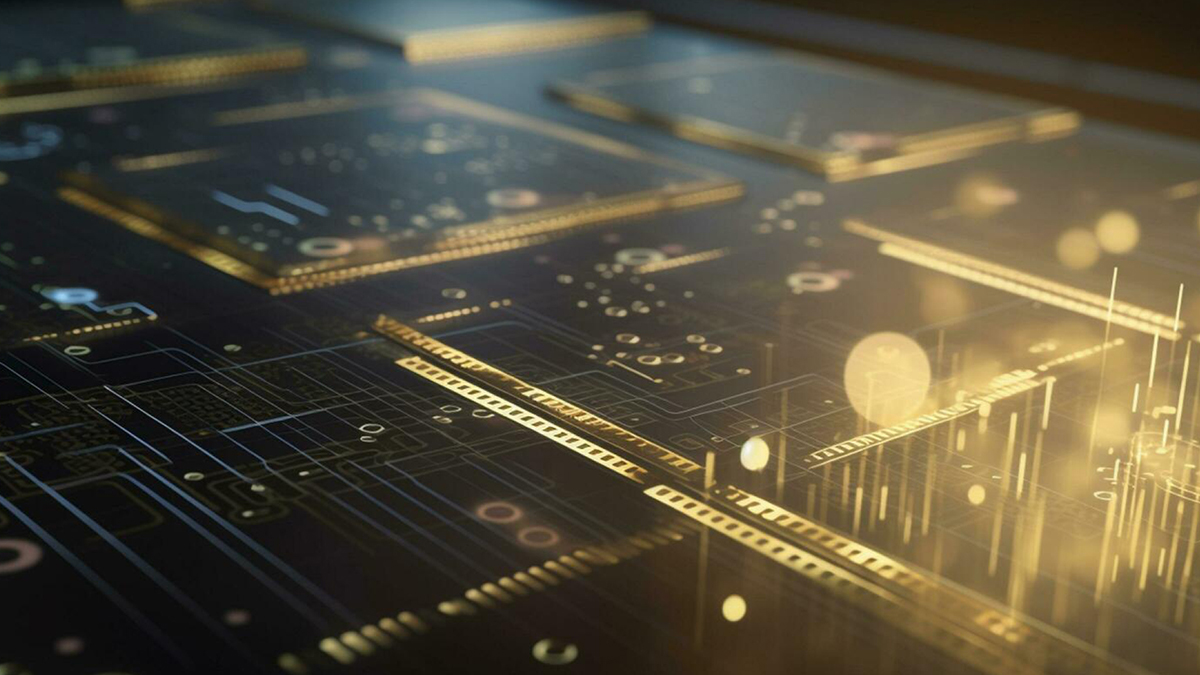

Product Bookings, Product Backlog and Annual Recurring Revenue

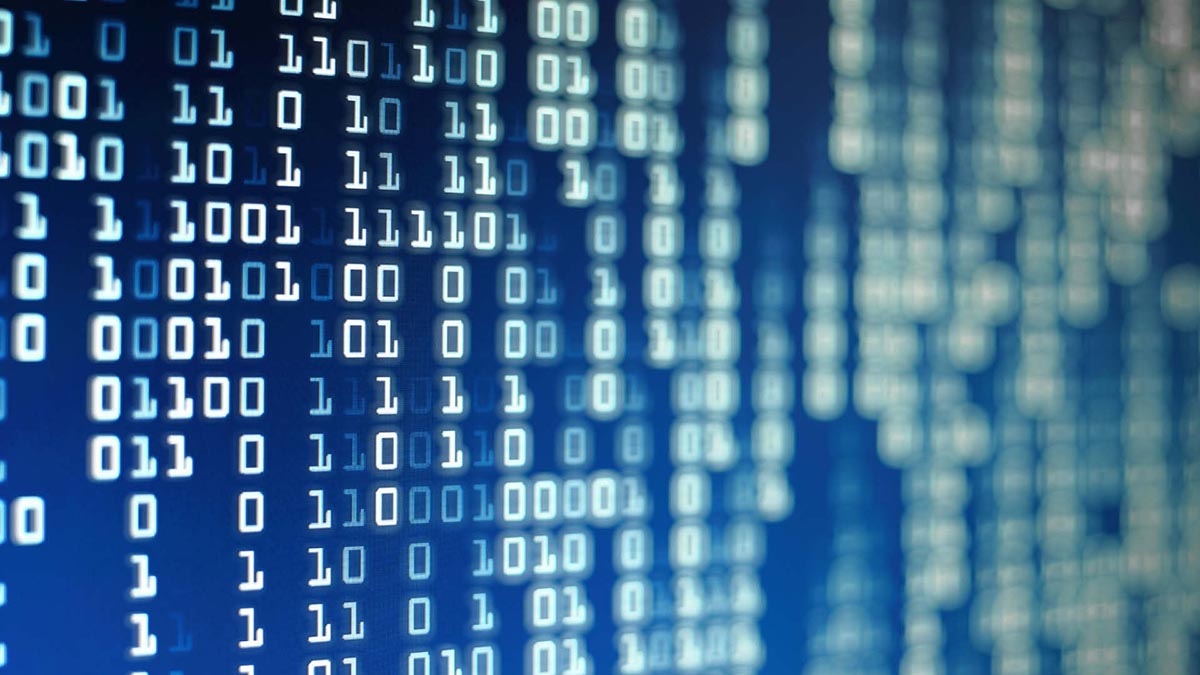

We utilize product bookings and Annual Recurring Revenue (“ARR”), each as further described below, as key performance metrics for our business. For the year ended December 31, 2025, product bookings were $535 million compared to $558 million for the year ended December 31, 2024, or a decrease of 4% year-over-year, as we are in the late stage of the XT upgrade cycle. The chart below summarizes our total product backlog and ARR