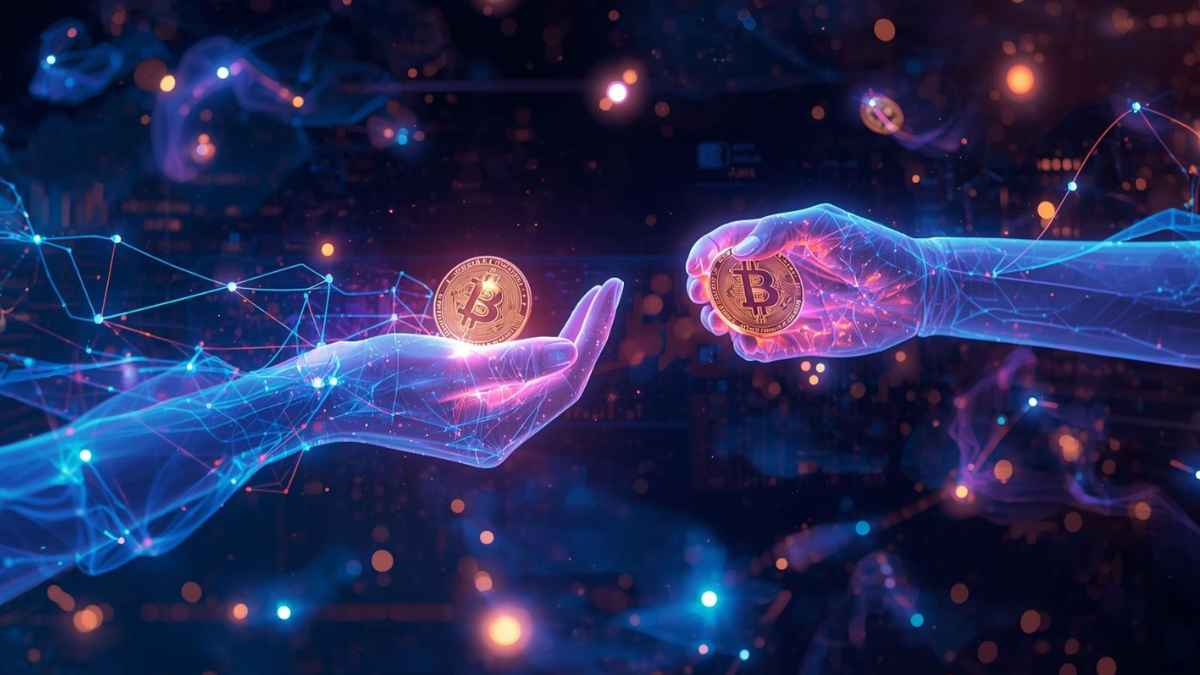

A next-generation fraud detection product that leverages AI capabilities to help businesses identify and prevent synthetic identity fraud, a complex and growing challenge that forces lenders to absorb significant financial loss. This new product leverages sophisticated machine learning algorithms to uncover fraud patterns that traditional methods may miss, detecting and flagging potential fraudulent activity before it impacts a company’s bottom line.

Synthetic identity fraud occurs when fraudsters couple elements of a real identity and manufactured components to create a new, fictitious identity. These fabricated identities are used to fraudulently open credit accounts or obtain loans, on which the fraudsters eventually stop making payments. Because these fabricated applicants often appear legitimate, synthetic identities can go undetected for long periods of time, leaving lenders exposed to significant charge-offs and revenue loss. According to Equifax data, the average cost or charged-off loss per known synthetic identity is approximately $13,000.1

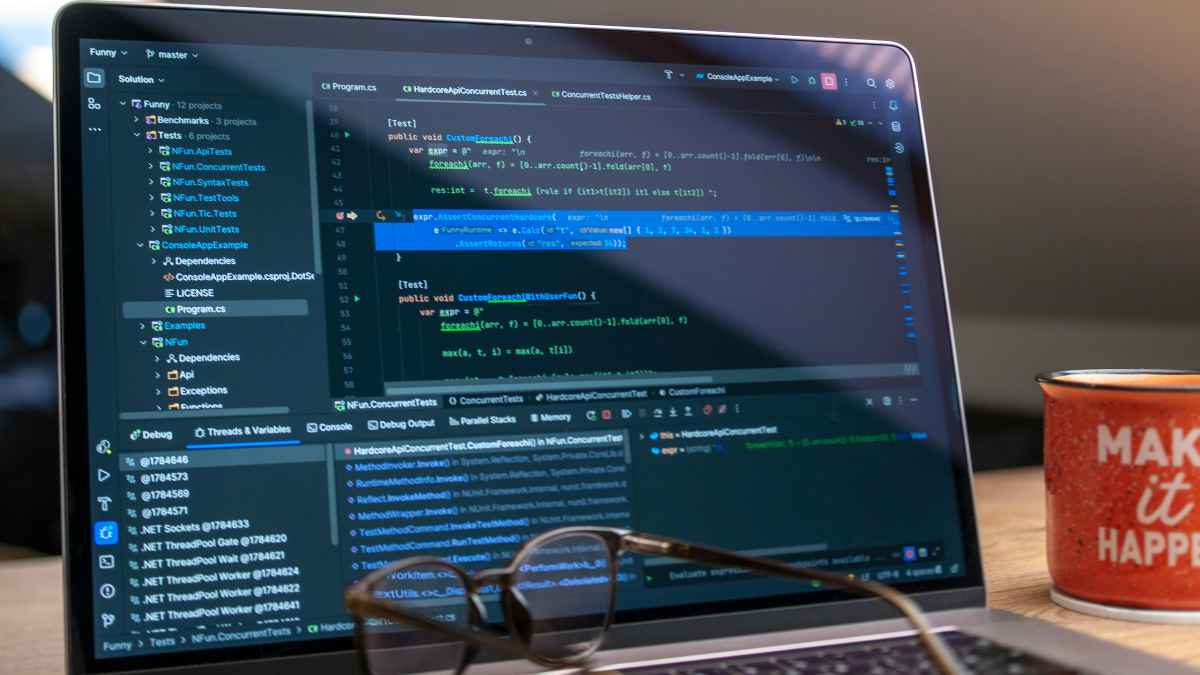

Leveraging patent-pending technology, Synthetic Identity Risk analyzes identity data, credit history and behavioral signals to assess the likelihood of synthetic identity activity. Synthetic Identity Risk can be used to detect potential fraud at account opening or it can be used as an account management tool to continuously identify hidden portfolio risk. Applying a holistic approach allows enterprises to make informed, real-time decisions about identity verification and fraud prevention.

“Synthetic identity fraud is a rapidly growing threat impacting the consumer lending ecosystem,” said Felipe Castillo, Chief Product Officer for U.S. Information Solutions at Equifax. “With Synthetic Identity Risk, Equifax strengthens lenders’ fraud defences, helping them to uncover hidden risks and ultimately shift from reactive loss recovery to proactive prevention. In doing so, they not only reduce their financial losses but they safeguard and build long-term trust with their legitimate customers.”