Today announced its unaudited financial results for the first six months of fiscal 2026, ended September 30, 2025.

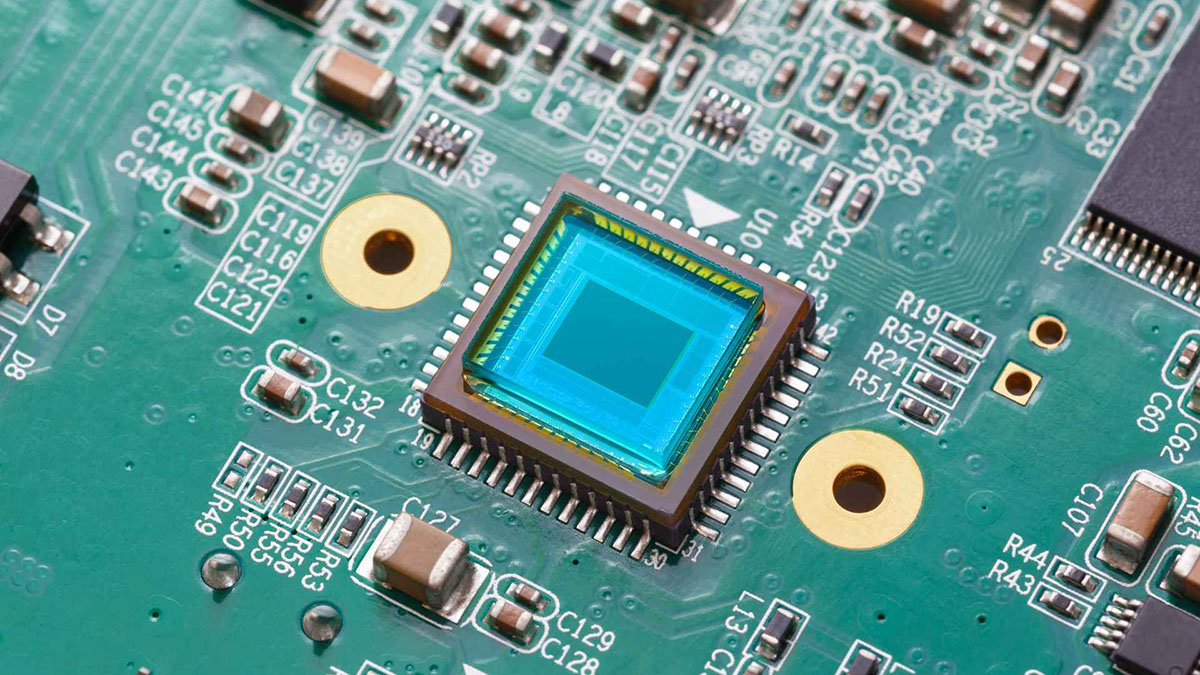

Net sales for the six months ended September 30, 2025 were $33.2 million, a decrease of 5.5% compared to net sales of $35.2 million for the six months ended September 30, 2024. Net sales decreased by 13.8% to $5.0 million in the plastic segment and by 3.9% to $28.2 million in the Company’s electronic segment.

Total gross margin was 23.4% of net sales during the six months ended September 30, 2025, as compared to 19.5% for the corresponding period of last year. Gross margin in the plastic segment decreased slightly to 18.3% of net sales in the segment for the first half of fiscal 2026, compared to 19.5% of net sales in the segment for the corresponding period of last fiscal year. As a percentage of sales, gross margin in the plastic segment slightly decreased due to an increase in labor costs resulting from the raise in minimum hourly wage, offset by continued control in the consumption of raw materials in the first six months of fiscal 2026. Gross profit margin in the electronic segment increased to 24.3% compared to 19.5% of net sales in the segment for the first half of last fiscal year. This was mainly due to higher-margin offerings, justified by enhanced value-added services delivered to customers, and continuous cost control measures in raw materials and labor costs for the first six months of fiscal 2026. Operating income in the first half of fiscal 2026 was $2.5 million, compared to operating income of $1.8 million for the same period of fiscal 2025.

The Company reported net income of $7.5 million for the six months ended September 30, 2025, compared to net income of $6.2 million for the six months ended September 30, 2024. This was primarily due to increases in total gross margin and non-operating income for the six months ended September 30, 2025, as compared to the same period of fiscal 2025. Deswell reported basic and diluted income per share of $0.47 for the first half of fiscal 2026 (based on 15,935,000 and 15,935,000 weighted average shares outstanding, respectively), as compared to basic and diluted income per share of $0.39 for the first half of fiscal 2025 (based on 15,935,000 and 15,935,000 weighted average shares outstanding, respectively).

The Company’s financial position remained strong, with $23.4 million in cash and cash equivalents and working capital totaling $85.1 million as of September 30, 2025. Furthermore, the Company has no long-term or short-term borrowings as of September 30, 2025.

Mr. Edward So, Chief Executive Officer, commented, “To date in fiscal year 2026, our performance reflects our resilience amid a challenging global economic landscape. While overall sales declined, driven primarily by softened worldwide demand, gross margins expanded as a result of higher-margin offerings with enhanced value-added services delivered to customers. New product introductions continue to outperform legacy lines, demonstrating the strength of our innovation pipeline. As we navigate a challenging economic landscape, our strategic priorities – accelerating speed-to-market, rigorous internal cost controls, close supplier partnerships, and targeted reinvestments – position us to stabilize performance and preserve competitiveness through the current cycle.”

Read Also: Dot Ai Appoints Miles Bradley as Director of Channels to Accelerate Partner Growth