In the fast-paced world of Business-to-Business (B2B), maintaining regulatory compliance is not just a legal obligation—it’s a strategic advantage. As companies exchange goods, services, and data, they must navigate an increasingly complex web of industry regulations, data protection laws, and contractual obligations. Failure to comply can result in hefty fines, reputational damage, and lost business opportunities. This article outlines key strategies to help B2B organizations successfully navigate regulatory compliance.

1. Understand the Regulatory Landscape

The first step in achieving compliance is understanding the relevant regulatory frameworks that apply to your industry. Regulations may vary widely depending on your sector, geographical markets, and the nature of your services. Common regulatory areas in B2B include:

- Data Protection and Privacy: Laws such as the General Data Protection Regulation (GDPR) in Europe, California Consumer Privacy Act (CCPA), and other local data privacy laws impose strict controls over how customer and business data are collected, stored, and shared.

- Financial Regulations: For B2B firms in finance, regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements govern transactional transparency.

- Product and Safety Standards: Industries such as manufacturing and chemicals must adhere to safety and environmental standards (e.g., RoHS, REACH).

- Industry-Specific Compliance: Some sectors, such as healthcare or defense contracting, have highly specific regulatory frameworks, like HIPAA or ITAR.

2. Conduct a Compliance Risk Assessment

A thorough risk assessment helps identify where your business is vulnerable to regulatory breaches. Key steps include:

- Mapping data flows to understand where sensitive information is collected, processed, and stored.

- Evaluating third-party vendors for compliance risks, especially those that handle customer data or critical infrastructure.

- Identifying gaps in existing policies, procedures, or technology controls.

This process provides a clear picture of your current compliance posture and highlights priority areas for action.

3. Implement Strong Policies and Procedures

Well-documented policies and standard operating procedures (SOPs) are essential to ensure consistent compliance practices across the organization. Best practices include:

- Defining clear roles and responsibilities for compliance-related tasks.

- Establishing clear processes for data handling, reporting incidents, and responding to regulatory inquiries.

- Regularly updating policies to reflect changes in laws or business operations.

Training employees at all levels is crucial so that they understand their role in maintaining compliance.

4. Leverage Compliance Technology

In the digital age, manual compliance processes are increasingly inefficient and error-prone. Implementing compliance software solutions helps automate key functions such as:

- Data privacy management (e.g., automated data subject access request processing).

- Regulatory change tracking to stay informed about new rules and deadlines.

- Audit trails that provide transparent records of compliance activities.

Cloud-based solutions can provide scalable, centralized compliance management, especially valuable for multinational B2B operations.

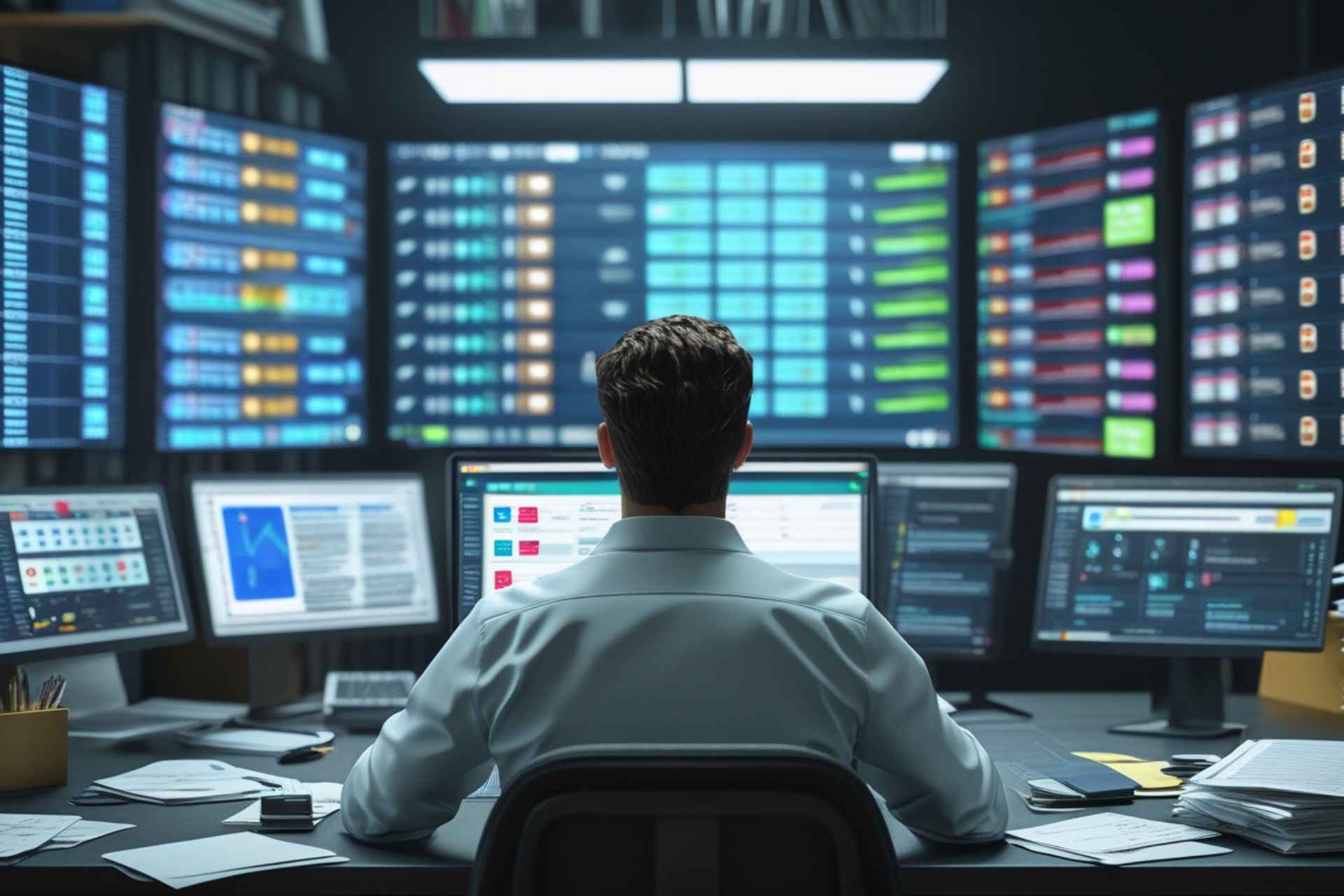

5. Monitor, Audit, and Continuously Improve

Compliance is not a one-time project; it’s an ongoing process. Regular internal audits and continuous monitoring are vital to ensure policies are followed and to detect emerging risks early. Key strategies include:

- Periodic risk assessments as business processes and regulatory environments evolve.

- Conducting employee training refreshers to maintain awareness and accountability.

- Establishing whistleblower channels to encourage reporting of potential violations.

An iterative approach enables your organization to adapt to regulatory changes and continuously strengthen your compliance posture.

6. Collaborate with Legal and Industry Experts

Navigating complex regulations often requires expert guidance. Building relationships with legal advisors, industry associations, and specialized compliance consultants helps you interpret laws correctly and stay informed of best practices. Additionally, engaging with industry peers through forums and working groups provides valuable insights into common challenges and practical solutions.

Conclusion

Regulatory compliance in the B2B space is an ongoing challenge, but one that can be turned into a competitive differentiator. By proactively understanding regulatory requirements, conducting risk assessments, implementing strong policies, leveraging technology, and engaging experts, businesses can build resilient compliance programs that protect both their reputation and bottom line. In today’s environment, being compliant is not just about avoiding penalties—it’s about building trust with partners, customers, and regulators alike.

Read Also: Key Statistics Every B2B Marketer Should Know in 2025