Cash flow is the lifeblood of every business, but for B2B enterprises, managing it can be particularly challenging. Long payment cycles, complex contracts, and high operating costs often create cash flow gaps that threaten stability and growth. Effective cash flow management ensures that a company has enough liquidity to cover obligations while also funding innovation and expansion.

Why Cash Flow Management Matters in B2B

Unlike B2C businesses where sales often result in immediate payments, B2B companies frequently deal with 30-, 60-, or even 90-day credit terms. This delay between delivering goods or services and receiving payment can create significant pressure on working capital. Poor cash flow management can lead to:

- Missed payroll or vendor payments

- Increased borrowing costs

- Stalled growth and lost opportunities

- Damaged creditworthiness

Key Strategies for Managing Cash Flow

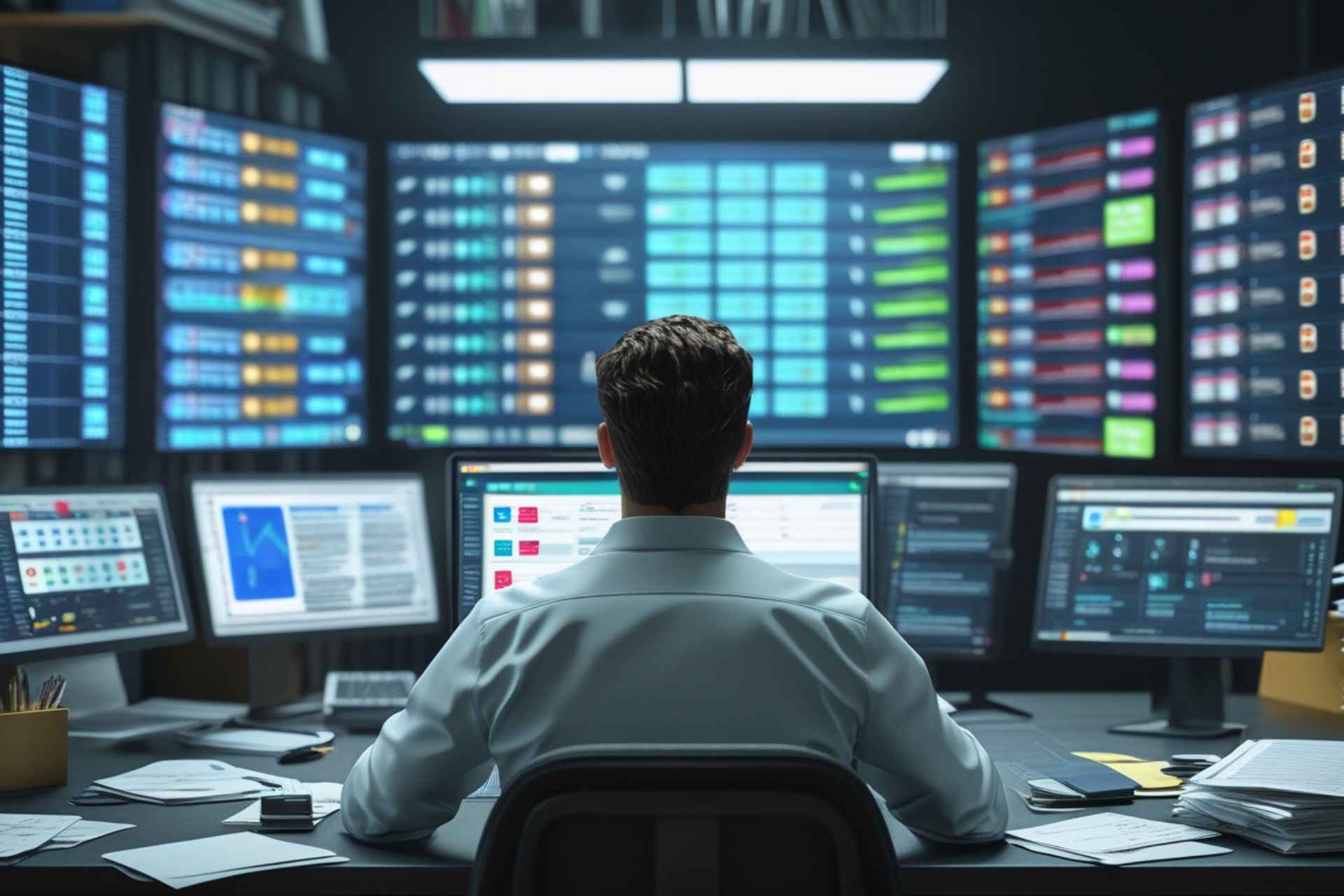

- Forecast and Monitor Cash Flow

Regular cash flow forecasting helps anticipate shortfalls and surpluses. By projecting inflows and outflows weekly or monthly, businesses can plan for contingencies, allocate resources wisely, and avoid unpleasant surprises.

- Streamline Invoicing and Collections

Delays in sending invoices or following up on payments exacerbate cash shortages. Automating invoicing, setting clear payment terms, and offering multiple payment options can accelerate collections. Consider early payment incentives or late-payment penalties to encourage timely settlements.

- Negotiate Favorable Terms

B2B enterprises should negotiate longer payment terms with suppliers and shorter terms with customers to reduce the cash gap. Strong relationships with vendors and clients can help achieve more flexible arrangements.

- Use Financing Tools

Options such as invoice factoring, supply chain financing, and business lines of credit can provide liquidity when payments are delayed. While financing comes with costs, it can help maintain operations and fund growth without disruption.

- Control Operating Expenses

Keeping overhead costs lean improves cash availability. Regularly reviewing subscriptions, renegotiating contracts, and optimizing inventory management reduces waste and frees up working capital.

- Build a Cash Reserve

Creating a cash buffer helps businesses weather downturns, delayed payments, or sudden expenses. Even setting aside a small percentage of profits each month can strengthen resilience.

Best Practices for Sustainable Cash Flow

- Leverage Technology: Use accounting software with real-time dashboards to track receivables, payables, and forecasts.

- Segment Customers: Identify high-risk clients and implement stricter credit checks or upfront payment requirements.

- Align Sales and Finance: Ensure sales teams understand how contract terms impact cash flow before finalizing deals.

Read Also: How to Build Long-Term B2B Partnerships