In today’s rapidly evolving technological landscape, mergers and acquisitions (M&A) have become a strategic imperative for businesses seeking to gain a competitive edge. As firms grapple with the complexities of integrating disparate systems, cultures, and data, the role of technology has emerged as a critical factor in determining the success or failure of such endeavors.

Central to any M&A strategy is the effective management and integration of data. The merging of two companies often involves the consolidation of vast, disparate datasets, each with its own unique structure and format. This presents significant challenges in terms of data quality, compatibility, and security. By developing robust data integration strategies, firms can establish a unified foundation for decision-making, improve operational efficiency, and comply with regulatory requirements.

One of the most pressing concerns in M&A deals is cybersecurity. The merging of IT infrastructures can create new vulnerabilities that malicious actors may exploit. To mitigate these risks, thorough due diligence must be conducted to identify potential security weaknesses and implement appropriate safeguards. This includes measures such as network segmentation, intrusion detection systems, and employee training to foster a culture of security awareness.

Cloud computing has emerged as a powerful tool for M&A, offering scalability, flexibility, and cost-effectiveness. By leveraging cloud-based solutions, firms can streamline the integration process, reduce operational costs, and enhance collaboration across distributed teams. Cloud-based platforms also provide a scalable infrastructure that can accommodate the changing needs of the merged entity.

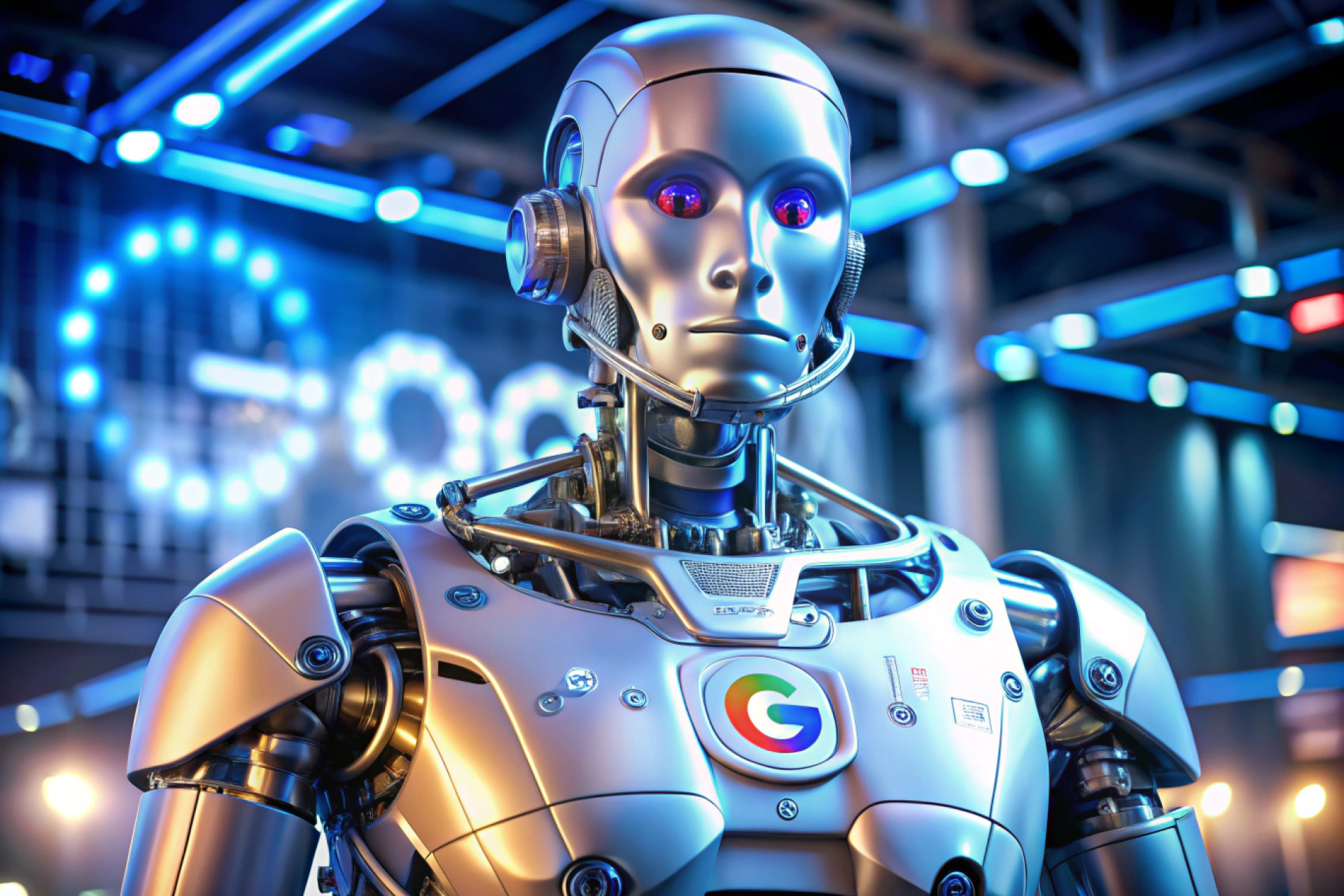

Artificial intelligence (AI) and automation are transforming the M&A landscape by automating routine tasks, improving decision-making, and accelerating the integration process. AI-powered analytics can uncover hidden patterns and insights within vast datasets, enabling firms to identify potential synergies and optimize operations. Automation tools can streamline processes such as due diligence, contract management, and employee onboarding, freeing up resources for more strategic initiatives.

Cultural alignment is another critical factor in the success of M&A deals. While technology can facilitate integration, it cannot bridge cultural divides. Firms must develop strategies to foster a shared sense of purpose, values, and identity. This may involve cross-cultural training, leadership development programs, and open communication channels.

Beyond these core considerations, technology can also play a crucial role in enabling post-merger value creation:

- Enhanced customer experience: Leveraging technology to deliver personalized experiences, improve customer service, and drive customer loyalty.

- Innovation and product development: Accelerating innovation by combining the strengths of both companies and leveraging emerging technologies.

- Cost optimization: Identifying cost-saving opportunities through technology-enabled process optimization and automation.

- Risk management: Using technology to monitor and mitigate risks associated with the merger, such as supply chain disruptions or cybersecurity threats.

In conclusion, technology is no longer just a tool for M&A; it has become a strategic imperative. By carefully considering factors such as data integration, cybersecurity, cloud adoption, AI, automation, and cultural alignment, firms can navigate the complexities of M&A and create sustainable value for their stakeholders. As the technological landscape continues to evolve, businesses must remain adaptable and embrace innovation to stay ahead of the curve.