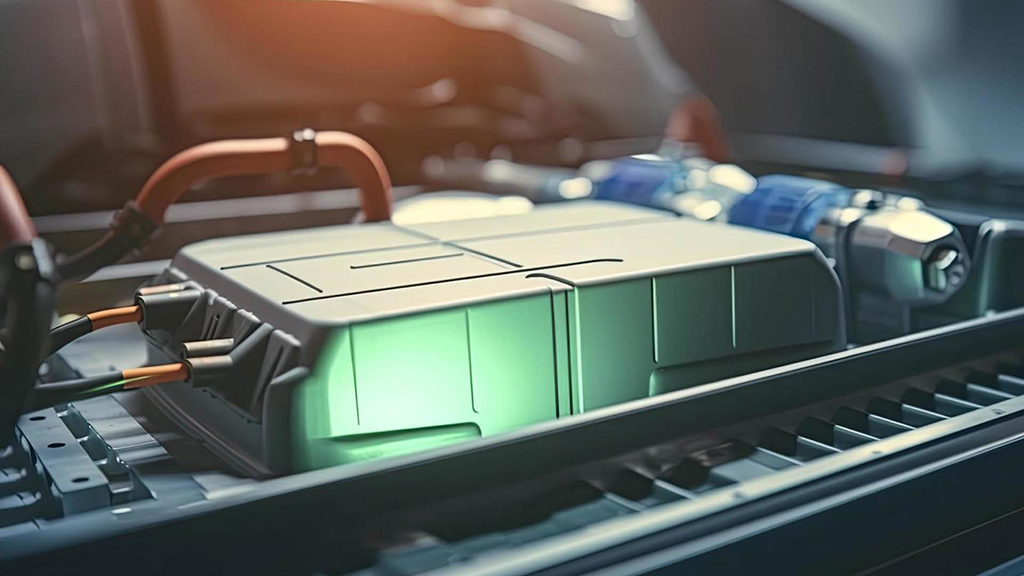

The India EV battery swapping market has generated USD 10.2 million revenue in 2022, which is projected to rise at a rate of 25.20% to 2030, to reach USD 61.57 million. P&S Intelligence attributes it to the reducing costs of electric vehicles and the need for a shorter time in the queue for charging.

Rising Demand for Shared Electric Mobility Key Opportunity for Players

The increasing traction of electric rickshaws in last-mile mobility, electric scooters in B2B sharing services, and electric cars in ride-hailing fleets fuels the industry growth. Moreover, vehicles without pre-installed batteries can now be registered, which is likely to propel industry development in the coming years.

Rising Road Traction of Electric Three-Wheelers

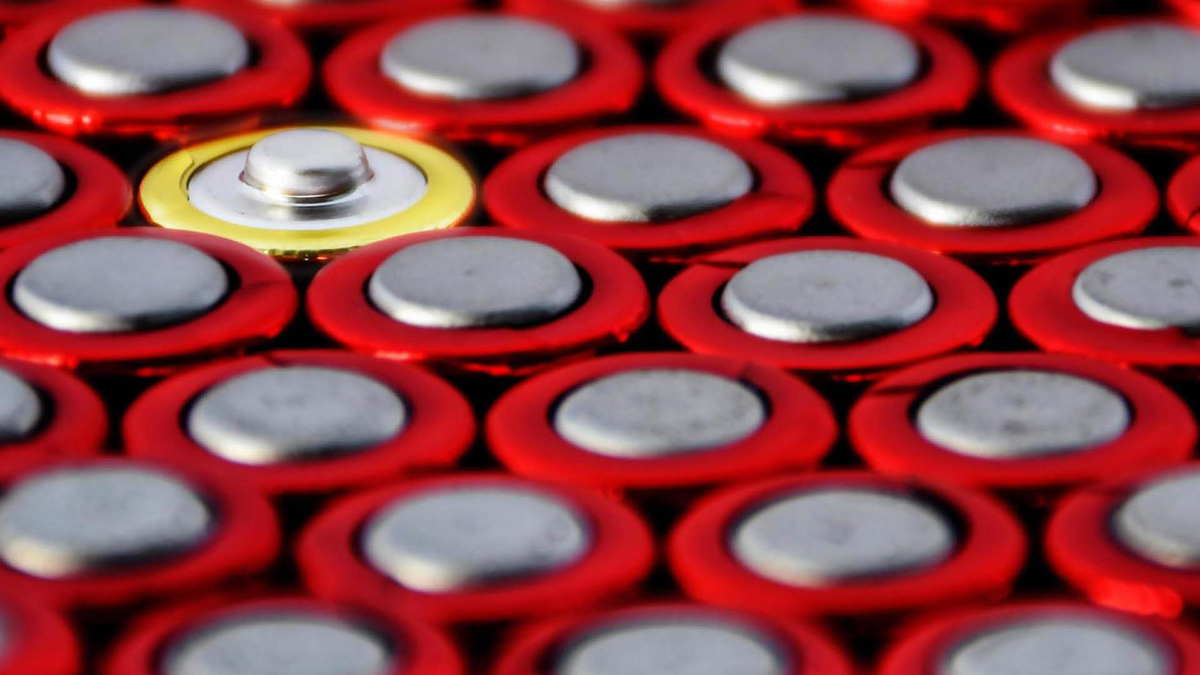

Three-wheelers captured a share of 90% in 2022, as battery swapping techniques can increase the life of electric load and passenger carriers significantly. On average, these vehicles cover over 100 km on a daily basis and require regular charging of the battery.

The swapping of the batteries decreases the downtime over conventional charging methods, thus making this technology popular among e-rickshaw operators in the country. Furthermore, the initiatives taken by OEMs and civic agencies to deploy replaceable batteries in EVs and set up swapping centers drive the revenue for service providers.

Increasing Battery Swapping Demand for Two-Wheeled EVs

● The two-wheeler category will likely experience a growth rate of 32% in the future. This is credited to the government incentives and subsidies on their purchase, rising environmental consciousness, and stringent emission standards.

● Moreover, OEMs are introducing advanced e-two-wheelers in the country with the ability to cover longer distances on a full charge and offer a high speed compared to the earlier models.

Subscription Model vs Pay-Per-Use Model

● Battery swapping subscriptions capture the major revenue share. Electric buses ply on routes and have the same number of stoppages, which allows drivers to know the distance they cover on a regular basis. This makes having a long-term subscription economical for them over paying for every single swap.

● The pay-per-use model will experience considerable growth in the coming years. Electric rickshaws usually ply for 12 to 15 hours and cover over 100 km every day.

Browse detailed report on India EV Battery Swapping Market Size, Share and Growth Forecast Report 2030

Uttar Pradesh Extensively Deploying EV Battery Swapping Models

Uttar Pradesh holds the largest industry revenue share. It is due to the fact that it houses the largest electric scooter and motorcycle market in India. Furthermore, seeing the positive outlook for the EV industry in the tier 2 and 3 cities of the state, the major OEMs are building networks with battery swapping centers to increase their penetration.