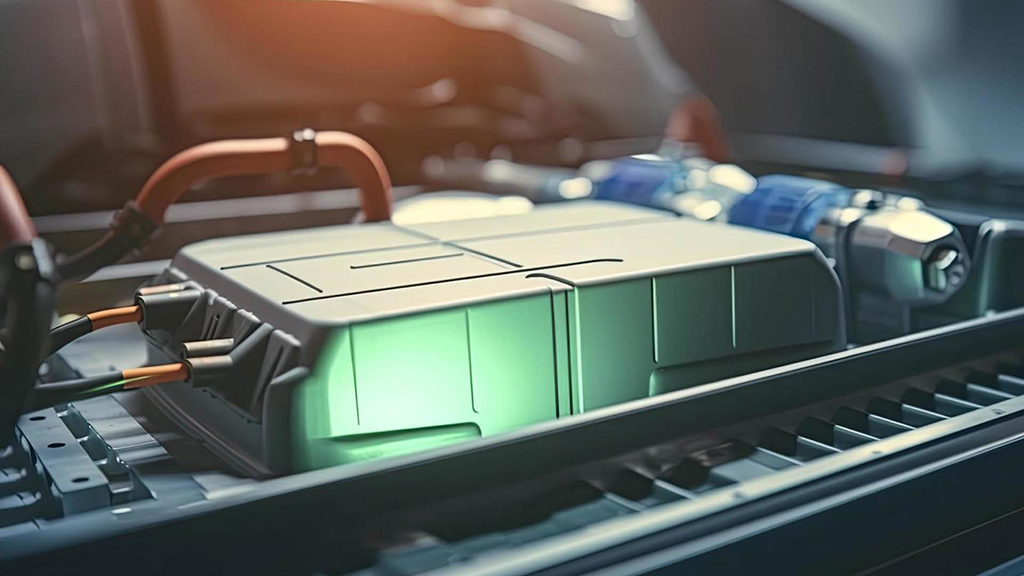

Over 1GWh of batteries are now sailing on waters globally, reflecting 72% industry growth in 2022. Despite this, there have been several challenges that shipbuilders and maritime battery suppliers have had to navigate in recent years.

Firstly, electric ship markets have historically been underpinned by electric ferry orders, which made up 37% of the maritime battery capacity (GWh) deliveries between 2019 and 2022. Norway is a key driver behind this, with around 100 electric ferries in operation – the most in the world. However, IDTechEx expects market saturation here soon as government targets are set to be surpassed next year.

Electric and hybrid vessels are also typically new-builds, specifically designed to be efficient with electric propulsion. However, the recent climate of uncertainty and inflation arising from the pandemic and the Russia-Ukraine war has had a negative impact on new-build contracts, including on ship-types targeted for electrification.

The IDTechEx report “Electric Boats & Ships 2024-2044” provides granular 20-year forecasts in unit sales, battery demand (GWh) & battery market value ($ bn) for electric ferry, electric cargo/container, electric Ro-Ro, electric cruise, electric OSV, electric tugboat and electric recreational boats by power class (<1kW, <12kW, >25kW). Based on primary supplier interviews, it further shares technology analysis and price information on marine Li-ion battery systems ($/kWh 2020 – 2044) and electric propulsion systems.

The future of the electric ship industry lies with hybrid cargo vessels. While this has not been a major historic market, new contracts for container ships have been steady. IDTechEx expects that zero-emission anchorage requirements, upcoming IMO and EU regulations, and the possibility for larger battery systems per vessel will drive battery installations.

The potential is huge. Less than a percent of the global merchant fleet currently runs on alternative fuels (including batteries), and battery systems improve the efficiency of both engines and future technologies such as hydrogen fuel cells. Systems sizes per vessel have also been increasing and can span into the tens of mega-watt hour per vessel – another driver for growth.

As the market develops, competition from China is also heating up. China-based battery suppliers are finding success in offering low prices for type-approved marine battery systems. This is achieved with high levels of vertical integration and battery chemistries such as LFP, which is predominantly manufactured in China. Contemporary Amperex Technology (CATL), one of the world’s largest battery suppliers, is a good example. The company set up a subsidiary to develop batteries for ships in 2022 and has already contracted or delivered at least 16MWh.

In the short term, marine battery suppliers outside China may command a premium due to very high levels of experience in this safety-critical sector. However, China’s entry will help consolidate and streamline the value chain as well as drive the next phase of growth for the industry as it sails into multi giga-watt hour territory.