The “Saudi Arabia Data Center Market – Investment Analysis & Growth Opportunities 2023-2028” report has been added to ResearchAndMarkets.com’s offering.

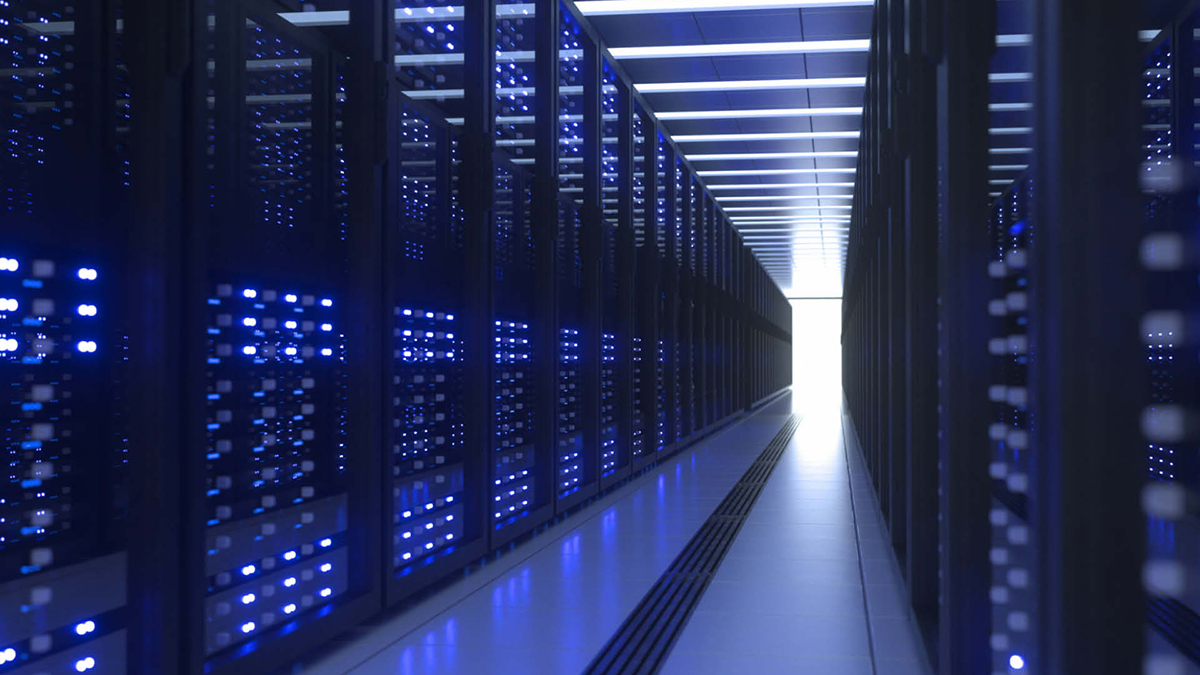

The Saudi Arabia data center market is expected to reach a value of $2.08 billion by 2028 from $1.31 billion in 2022, growing at a CAGR of 7.98% from 2022-2028

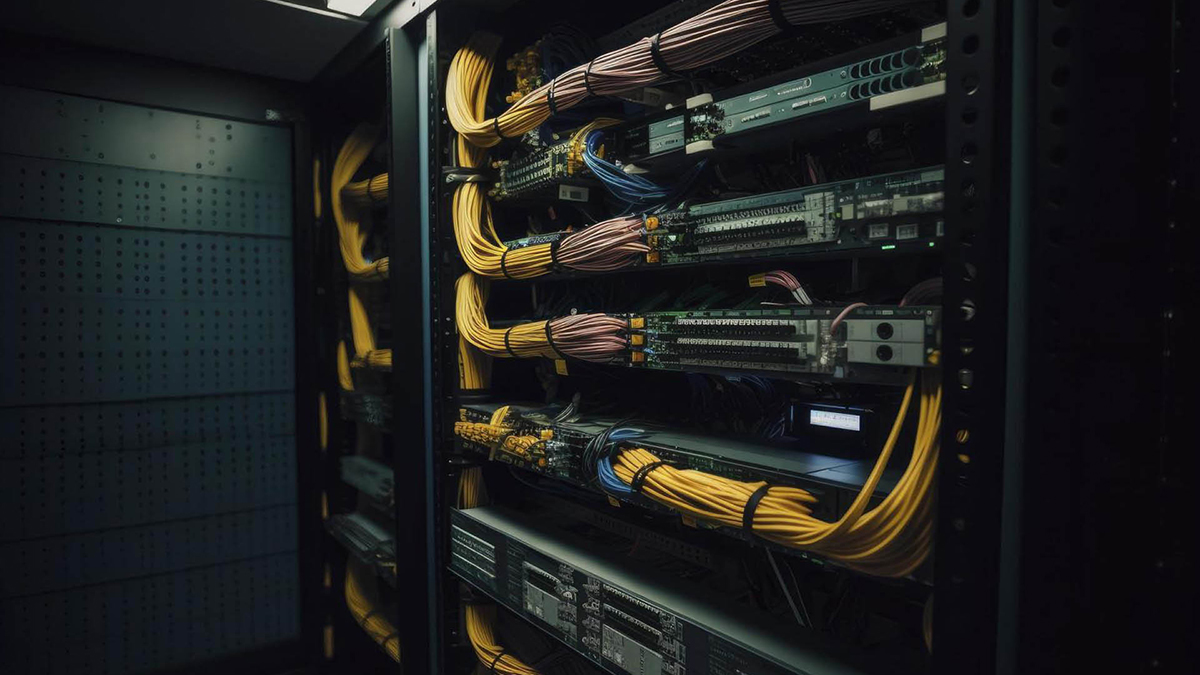

This report analyses the Saudi Arabia data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

Saudi Arabia has over 20 operational colocation data centers. Riyadh is the primary location for investment in the Saudi Arabia data center market, followed by Jeddah, Dammam, and other cities. Neom is the new smart city that will attract new investments over the forecast period.

Significant deployment and adoption of 5G services and the development of smart cities in Saudi Arabia will fuel data traffic and further grow the demand for more data centers in the country. For instance, Amazon Web Services announced the availability of AWS Outposts. This fully managed service offers AWS services and AWS infrastructure for a full virtual experience of a data center colocation space.

The country is also witnessing improvement in submarine and inland connectivity. For instance, 2Africa, the longest subsea cable, will be deployed to connect Saudi Arabia with other countries such as India, the UAE, Spain, the UK, Oman, and others.

Gulf Data Hub is among the top colocation operator in the country that is currently developing a new data center facility in Dammam and has further planned several facilities across Riyadh, Jeddah, and Dammam.

VENDOR LANDSCAPE

Some of the key colocation investors in the Saudi Arabia data center market in 2022 are Saudi Telecom Company (stc), Gulf Data Hub, Damac Data Centres (EDGNEX), ZeroPoint DC, and others.

Quantum Switch Tamasuk (QST), the joint venture between Quantum Switch and Tamasuk, aims to develop six facilities across Jeddah, Riyadh, Dammam, and Neom with a power capacity of around 300 MW by 2026.

The hyperscale operator Google announced its plan to develop a cloud and data center region in Saudi Arabia in partnership with Aramco and three availability zones likely to be online in the next 2-3 years.

Microsoft has also announced its entry into the Saudi Arabia data center market. In addition, Oracle Cloud has also planned to open a new cloud region in Riyadh with one availability zone.

WHY SHOULD YOU BUY THIS RESEARCH?

- Market size available in the investment, area, power capacity, and Saudi Arabia colocation market revenue.

- An assessment of the data center investment in Saudi Arabia by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across cities in the country.

- A detailed study of the existing Saudi Arabia data center market landscape, an in-depth industry analysis, and insightful predictions about industry size during the forecast period.

KEY QUESTIONS ANSWERED:

- How big is Saudi Arabia data center market?

- What is the growth rate of the Saudi Arabia data center market?

- How much will MW of power capacity be added across Saudi Arabia during the forecast period?

- What factors are driving the Saudi Arabia data center industry?

- Which all cities are included in Saudi Arabia data center market report?

Snapshot of existing and upcoming third-party data center facilities in Saudi Arabia

- Facilities Covered (Existing): 21

- Facilities Identified (Upcoming): 40

- Coverage: 6 Cities

- Existing vs. Upcoming (Area)

- Existing vs. Upcoming (IT Load Capacity)

Data center colocation market in Saudi Arabia

- Colocation Market Revenue & Forecast (2022-2028)

- Wholesale vs. Retail Colocation Revenue (2022-2028)

- Retail Colocation Pricing

- Wholesale Colocation Pricing

Major Vendors

IT Infrastructure Providers

- Arista Networks

- Atos

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Inspur

- Lenovo

- NetApp

Data Center Construction Contractors & Sub-Contractors

- ALEC Data Center Solutions

- Al-Latifia Trading and Contracting

- Ashi & Bushnag

- Atkins

- Aurecon

- Capitoline

- Critical Facilities Consulting & Services

- DC PRO BV

- Dar Group

- Edarat Group

- EGEC

- HATCO

- ICS Nett

- INT’LTEC Group

- JAMED

- Linesight

- RED

- SANA Creative Systems

- UBIK

Support Infrastructure Providers

- ABB

- Airedale

- Alfa Laval

- Canovate

- Caterpillar

- Cummins

- Eaton

- Enrogen

- Grundfos

- Legrand

- Mitsubishi Electric

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Gulf Data Hub

- Mobily

- Oracle

- Saudi Telecom Company (stc)

New Entrants

- Agility

- Damac Data Centres (EDGNEX)

- Microsoft

- Quantum Switch Tamasuk (QST)

- ZeroPoint DC

EXISTING VS. UPCOMING DATA CENTERS(Area and Power Capacity)

- Riyadh

- Jeddah

- Dammam

- Other Cities

REPORT COVERAGE:

IT Infrastructure

- Servers

- Storage Systems

Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- Dammam

- Other Cities