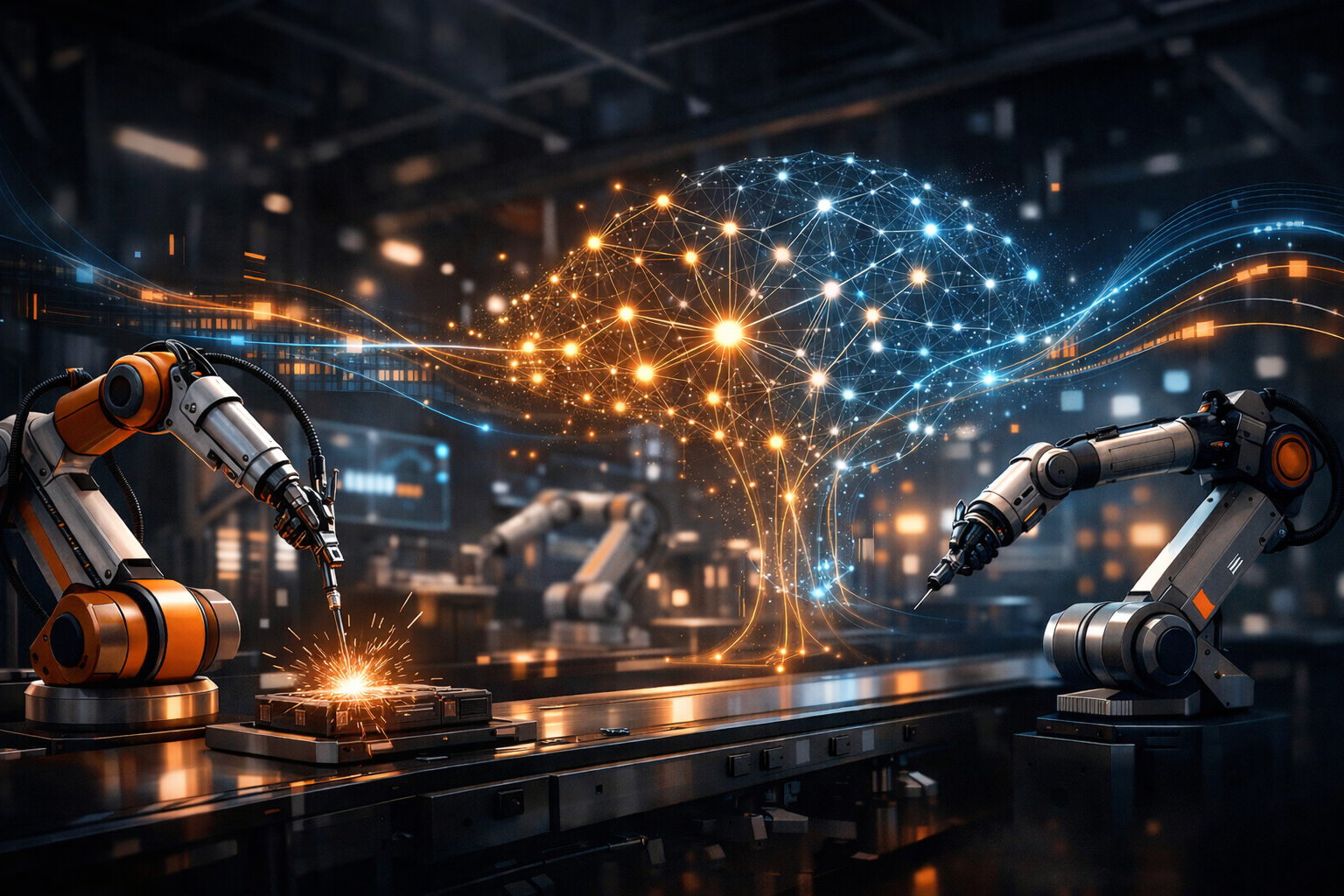

Digital lending platforms are revolutionizing the financial landscape, reshaping the way community banks, credit unions, and traditional lending institutions operate. Leveraging advanced technologies like artificial intelligence (AI), these platforms are streamlining and enhancing the entire lending process.

The shift towards digital lending is not merely a trend but a necessity. As technology continues to evolve, financial institutions (FIs) are embracing digital solutions to meet the evolving needs of their customers. Today, the majority of lending processes are conducted digitally, a stark contrast to the traditional paper-based methods of the past.

The digital lending ecosystem encompasses a diverse range of players, including traditional banks, fintech firms, and peer-to-peer lending platforms. A recent Mordor Intelligence report underscores the significant growth potential of this sector, projecting substantial expansion in the coming years.

Benefits of Digital Lending

Digital lending platforms offer numerous advantages for both financial institutions and borrowers:

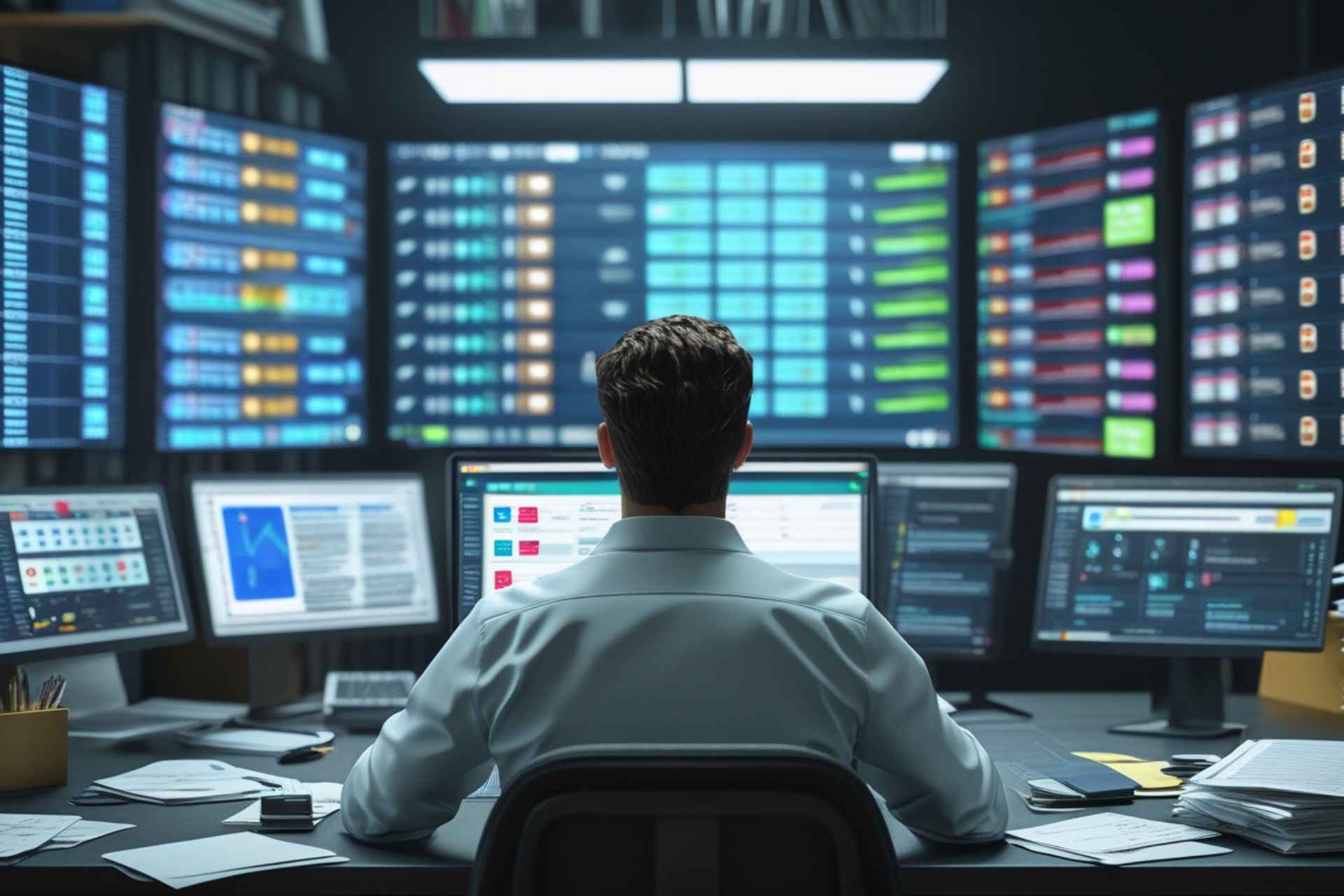

- Efficiency and Speed: By automating manual processes and leveraging real-time data analysis, digital lending significantly reduces processing time. Loan applications can be processed and approved within hours, rather than weeks.

- Reduced Operational Costs: Digital platforms streamline the application process, eliminating the need for physical paperwork and reducing administrative overhead. This translates to lower operational costs for lenders, which can be passed on to borrowers in the form of lower interest rates and fees.

- Enhanced Customer Experience: Digital lending platforms prioritize user experience, offering intuitive interfaces, quick customer support, and transparent tracking of loan status. This leads to increased customer satisfaction and loyalty.

- Improved Risk Assessment: AI-powered algorithms enable more accurate and efficient risk assessment by analyzing a wider range of data points. This allows lenders to make more informed decisions and offer tailored loan products to low-risk borrowers.

- Financial Inclusion: Digital lending platforms can extend financial services to underserved populations, including individuals in remote areas or those with limited access to traditional banking services.

Future Trends in Digital Lending

Several emerging trends are shaping the future of digital lending:

- Blockchain and Decentralized Finance (DeFi): Blockchain technology, known for its secure and transparent nature, has the potential to revolutionize lending by enabling peer-to-peer lending and tokenized assets on decentralized platforms. This could reduce reliance on intermediaries and increase efficiency.

- AI-Powered Underwriting and Personalized Loans: AI is playing an increasingly important role in underwriting and loan personalization. By analyzing vast amounts of data, AI algorithms can identify patterns and make more accurate credit decisions. This enables lenders to offer tailored loan products that meet the specific needs of individual borrowers.

- Responsible Lending and Financial Inclusion: As AI becomes more prevalent in lending, it is crucial to address ethical concerns and ensure fair and unbiased decision-making. Lenders must strive to promote financial inclusion and responsible lending practices.

Conclusion

The future of digital lending is bright, driven by technological advancements and changing consumer preferences. As digital platforms continue to evolve, we can expect to see further innovation, increased efficiency, and greater financial inclusion.