Open banking has emerged as a significant force in the financial industry, driven by technological advancements and a growing demand for customer-centric solutions. By enabling third-party providers to access and utilize financial data with user consent, open banking fosters competition, innovation, and greater choice for consumers.

Key Principles and Drivers:

- Data-driven Approach: Open banking leverages Application Programming Interfaces (APIs) to securely connect and share financial data between banks and third-party providers.

- Consumer Empowerment: At its core, open banking empowers consumers by providing them with greater control over their financial data and access to a wider range of services.

- Competitive Landscape: The increased competition fostered by open banking encourages financial institutions to innovate and develop more competitive products and services to meet evolving customer needs.

- Regulatory Framework: The European Union’s PSD2 directive has been instrumental in driving the adoption of open banking, with the UK’s Open Banking Standard serving as a leading example.

Benefits of Open Banking:

- Enhanced Customer Experience: Open banking allows for more personalized financial services, improved customer understanding, and the development of innovative digital solutions.

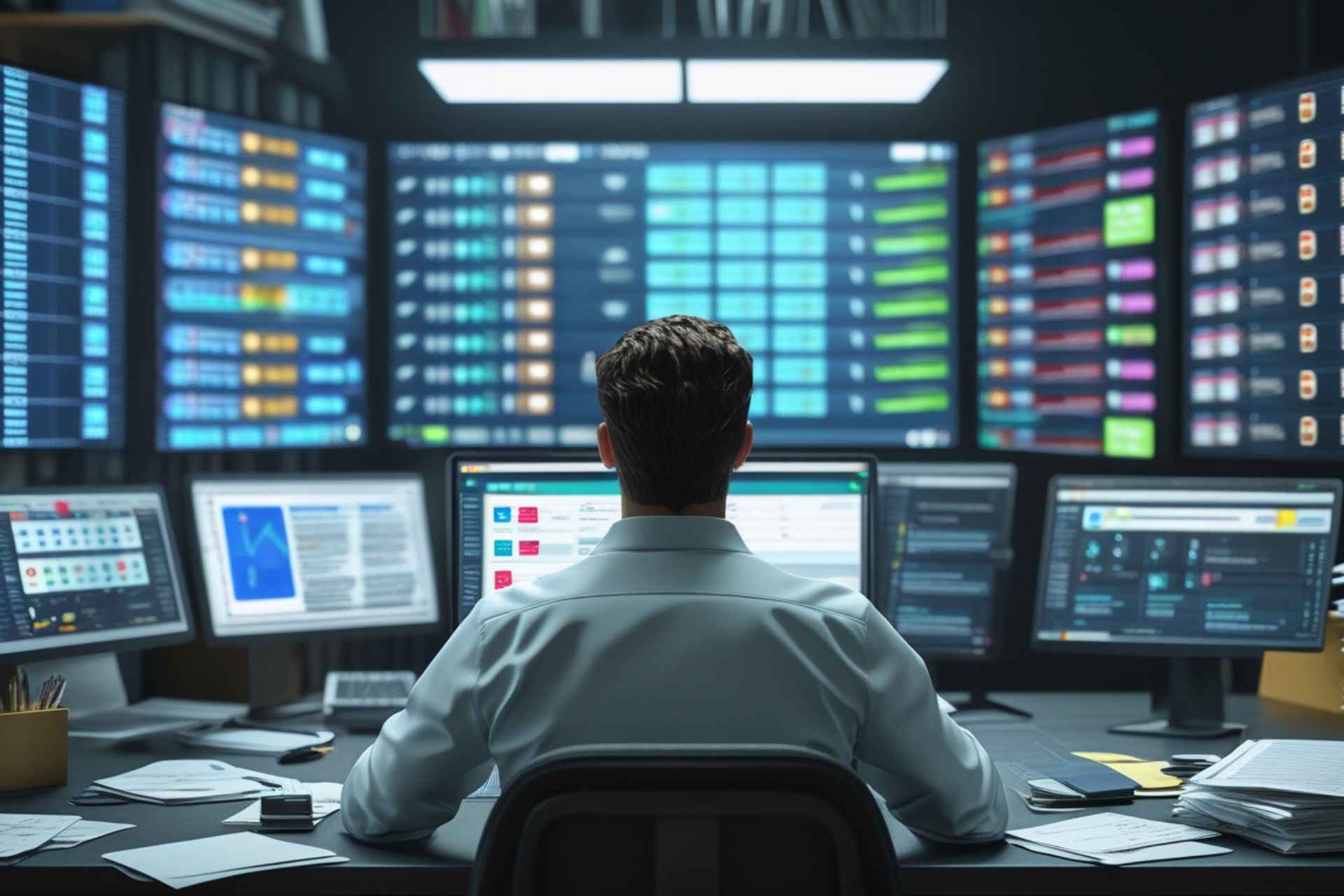

- Improved Efficiency: By facilitating data-driven decision-making and automating processes, open banking can enhance operational efficiency for both banks and consumers.

- Increased Competition: The competitive environment created by open banking drives innovation and encourages financial institutions to offer more competitive products and services.

- Financial Inclusion: Open banking can potentially improve financial inclusion by providing access to financial services for underserved populations.

Challenges and Considerations:

- Data Privacy and Security: Ensuring the secure and ethical handling of sensitive financial data remains a critical concern.

- Regulatory Uncertainty: The evolving regulatory landscape presents challenges in navigating compliance requirements and ensuring a level playing field for all participants.

- Technical Integration: Integrating open banking technologies and ensuring seamless interoperability between different systems can be complex.

- Consumer Trust: Building and maintaining consumer trust is crucial for the successful adoption of open banking.

The Future of Open Banking:

The future of open banking holds significant promise:

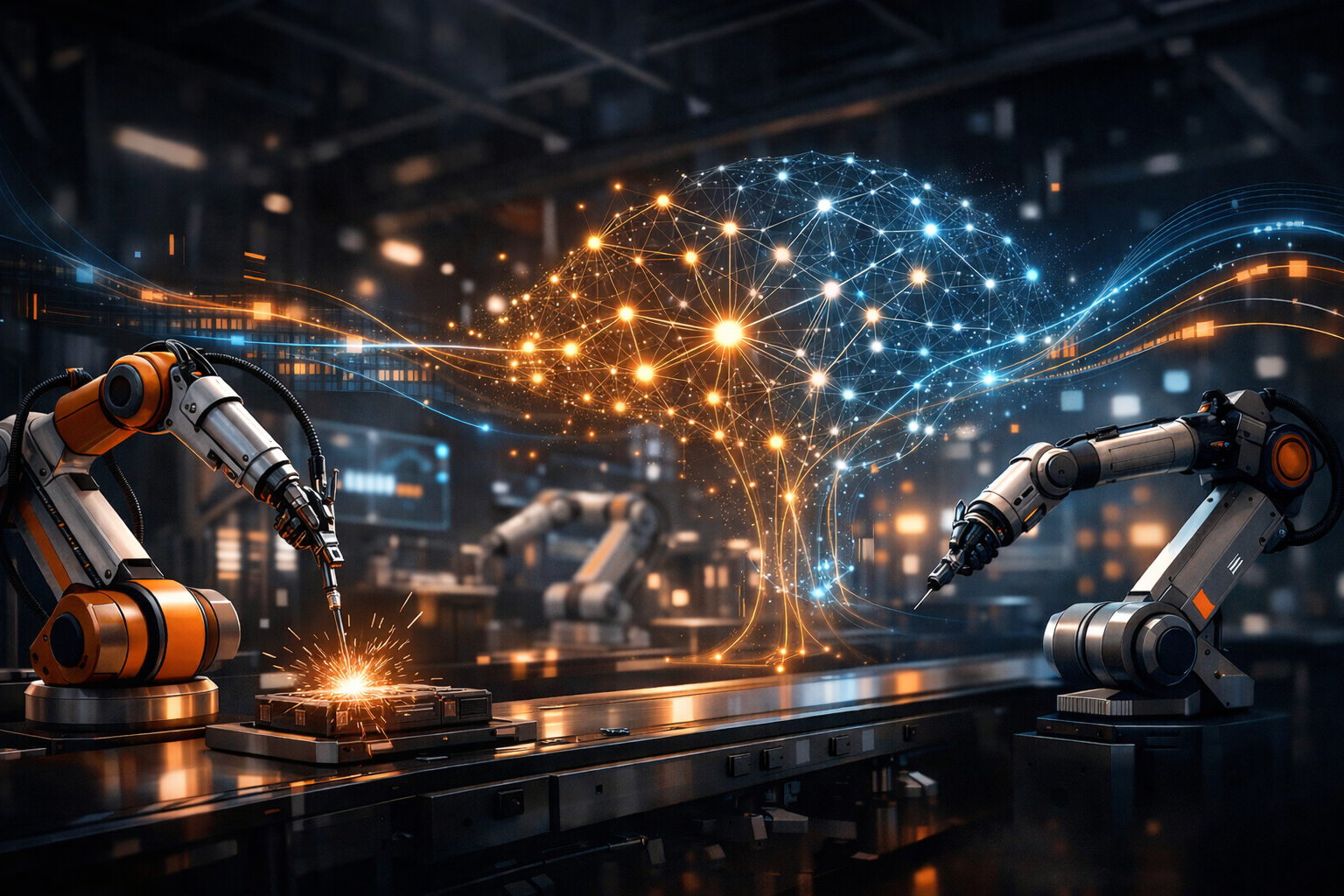

- Data-Driven Innovation: Advancements in data analytics and artificial intelligence will further fuel innovation in the financial services sector.

- Decentralized Data Storage: Blockchain technology may play a role in decentralizing data storage, enhancing data security and privacy.

- Improved User Interfaces: The development of user-friendly interfaces will be crucial for enhancing the customer experience and driving wider adoption.

- Enhanced Financial Management: Open banking will empower consumers with tools for better financial management, such as personalized budgeting and investment advice.

Conclusion:

Open banking is transforming the financial landscape by fostering a more customer-centric, competitive, and innovative ecosystem. While challenges remain, continued collaboration between regulators, financial institutions, and technology providers will be essential to ensure the successful and responsible evolution of open banking.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice.

This revised version focuses on the core concepts of open banking, removing any marketing-oriented language and providing a more objective and informative overview of the topic.